If you own a vehicle in Ontario, there are requirements around the types of insurance coverage you must purchase. Minimally, you must have:

- Third-Party Liability Coverage (minimum of $200,000 in coverage) – This protects you in the event someone else is killed or injured, or their property is damaged, as a result of your vehicle.

- Statutory Accident Benefits Coverage – Provides benefits in the event you are injured in an automobile accident.

- Direct Compensation – Property Damage (DC-PD) Coverage – This covers loss/damage to your vehicle or its contents if another person was at fault for the accident. It is called direct compensation because even though someone else causes the damage, you collect directly from your insurer.

- Uninsured Automobile Coverage – Protects you and your family if you are injured or killed by an unidentified/uninsured driver.

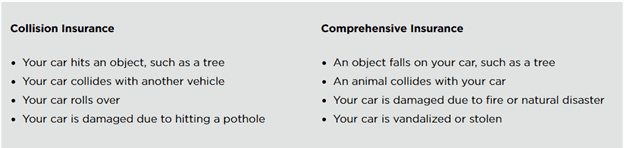

In addition to mandatory coverage, you can purchase insurance that increases your coverage. Two commonly-purchased coverages are collision insurance and comprehensive coverage. To understand whether you need these coverages, it helps to understand the difference between these options and the benefits they provide.

Collision Insurance

Collision Insurance covers damage to your vehicle in the event of a covered accident involving a collision with another vehicle or object, or if your vehicle rolls over. This may include repairs or a full replacement of your covered vehicle.

Comprehensive Insurance

Comprehensive car insurance pays for damage to your vehicle caused by covered events such as theft, vandalism, falling or flying objects, and/or natural disaster, which are not collision-related.

The following chart summarizes the coverage offered by collision and comprehensive insurance (Source: nationwide.com)

To determine whether you need these coverages, it is helpful to determine your risk, including the value of your vehicle, how often you drive it (the likelihood of an accident), the rates of theft in your area, the likelihood of a natural disaster, etc. Your broker can help you assess these considerations and determine the optimal coverage for your vehicle.